The link between crypto and collectible watches is becoming clearer

Ricardo SimeFor years, in the circles I’m a part of, watch collectors have been asking a simple question. As watch prices continue to skyrocket, who in the bloody hell is buying pieces at these premiums? Premiums that are two, three, sometimes four times the original retail price. We all agree that there are ridiculously wealthy people out there. But, when you factor in the niche percentage of watch collectors, something still didn’t compute. Well, that was until a recent article on Bloomberg shed some light on the subject.

Titled “Crypto Bros Can’t Afford Rolexes Anymore”, the article, by Mark Gongloff, draws a correlation between the recent decline in watch market prices to the decline in crypto value: “Luxury watch prices have recently fallen from ‘mortal soul’ levels to more reasonable ‘firstborn child’ levels, Andrea Felsted writes, thanks to crypto bros being carried out on their shields.”

When you think about the overnight millions made by many in cryptocurrency, and how the value of hyped pieces have gone up over the years, such a relationship makes sense. If I just became rich overnight, I would have definitely aimed for the big-name pieces in my following day shopping spree (WIS hat off, of course).

If you still don’t believe this, just look at how many watch brands started taking crypto as a form of payment.

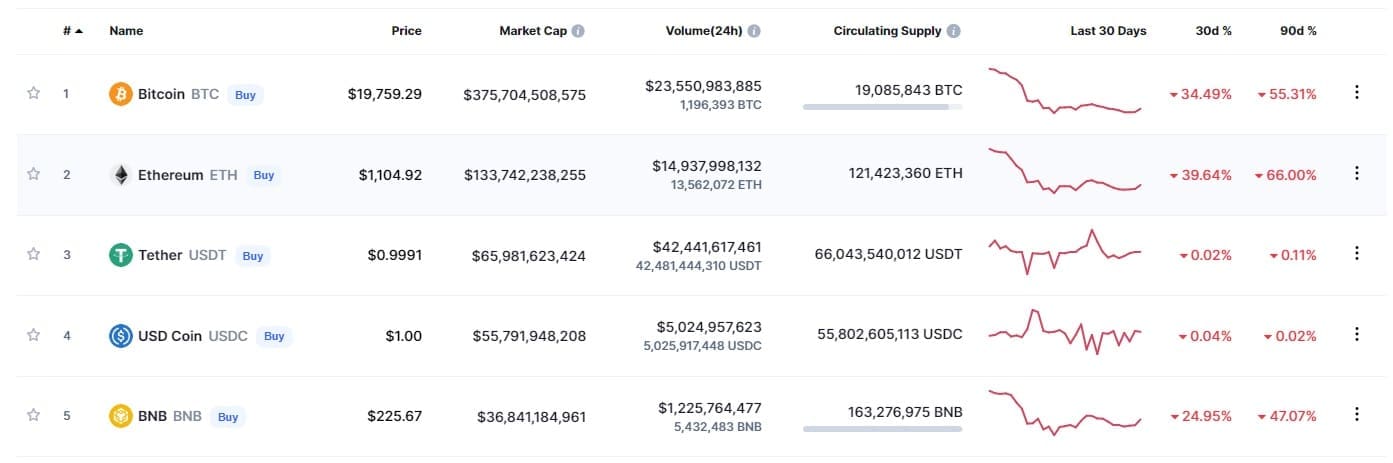

However, with crypto value declining sharply recently (popular currencies losing 55 to 66% of their value in the last 90 days), the party seems to be over. These Crypto Bros probably find themselves in one of two camps. Either they got into crypto late and bought coin at a high, and recently lost a ton of money. Or they got in early and are still up, but have decided to hold on to their money or even “buy the dip”. In both situations, the last thing on their minds is a luxury watch purchase.

This lack of crazy-rich buyers seems to have led to a decline in the watch market for these hyped pieces. Fewer and fewer people willing to pay anything for a hyped piece. Hyped watches like the Audemars Piguet Royal Oak, Patek Philippe Nautilus and Rolex Daytona have all seen their previous market value highs lose a few points these past few months. The article notes how a once $237,700 USD valued Patek Philippe Nautilus 5711/1A is now at $192,800 USD. As you can see, street prices — though lower — are still high. So don’t take this decrease to mean these pieces are more “attainable”.

Which begs the question, will this “correction” continue as crypto continues to dip? Only time will tell. For now, I’ll just cross my fingers and hope the Royal Oak 15550ST I want will only be 2x MSRP by Christmas.