Daytona drift: Where will the price slide end?

Zach BlassA few weeks back, Ricardo explored how the crash of crypto has derailed the upward trajectory of many “asset-class” references such as the Royal Oak and Nautilus. Recently, Business Insider has echoed Bloomberg‘s sentiments – zeroing in on the most beloved modern Rolex of all: the Daytona. With the Daytona being the most sought-after modern Rolex, it has the longest to fall. But, with no slowing of the slide, questions are now being asked – where exactly will it land?

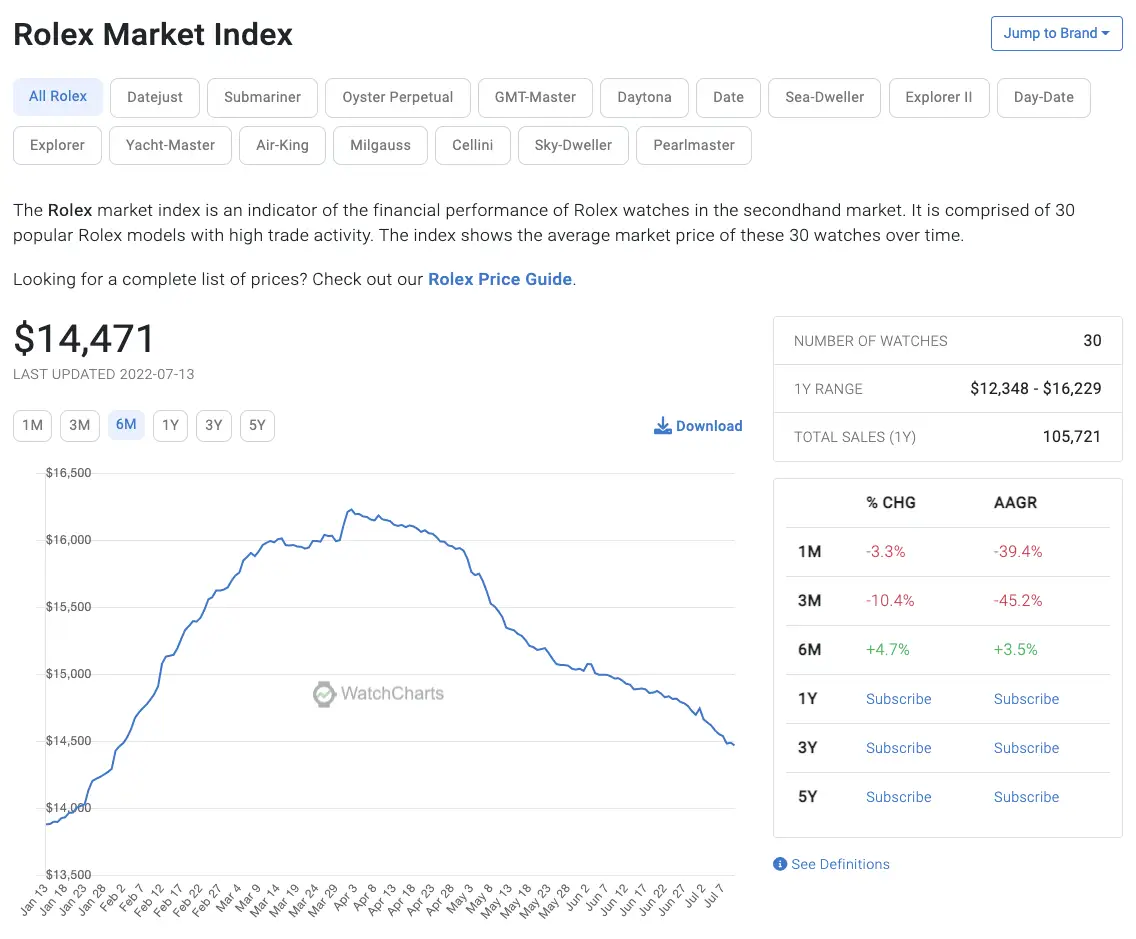

Dominick Reuter of Business Insider explains: “The crowd-favorite Cosmograph Ref. 116500 has been in a months-long slide from its peak in mid-March at around $48,500, down more than 16% to about $39,500 today, according to data from Watch Charts. The decline of that particular reference, along with others in its family, is driving a wider drop in the brand’s performance on the secondary market, which is down more than 10% over the past three months, per Watch Charts.”

Rolex premiums on the secondary market have always been perceived to be too high by the average watch buyer, but the boom between January and March of this year led prices to rise to what some would describe as peak insanity. Therefore, while not an economist by any means, I think the plummeting value of crypto has awoken a correction of sorts. But, will Rolex Daytonas gradually sell closer to retail in the coming months? Probably not.

“Paul Altieri, founder of Bob’s Watches, a leading Rolex reseller, told Insider the market was particularly hot from October until early May, during which prices jumped ‘it seemed like overnight’. Since then, Altieri said he’s seen a dip in the market for Daytonas at his shop, albeit somewhat less pronounced than the larger resale market tracked by Watch Charts.”

Altieri continued: “Money is still out there, and it’s gonna find good quality assets to buy. There’s just an insatiable appetite.”

Rolex products remain as scarce as ever in retail storefronts, so they will continue to sell well over retail prices on the secondary market. That being said, the insanely high peak premiums we saw in March are clearly declining. Will the Daytona secondary value dip below $30,000 USD though? I don’t see it happening.